Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

There are a lot of things I used to buy in person that I now buy online. I wouldn’t call myself lazy, but it’s just so much easier to carry a box of paper towels from my doorstep into my apartment than it is to carry it down the street from my local grocery store.

And I’m not alone. Whether it’s because of the larger selection, better pricing, convenience, or something else, a lot more people are buying stuff online nowadays instead of in person. Despite the growing number of online shoppers, people are still wary of the setbacks of paying for stuff online. In particular, people still get nervous about giving their personal and credit card information to online retailers.

If you’re an ecommerce business, a big part of attracting and delighting your customers will be providing them with a stable, reliable, secure, and smooth online shopping experience. That starts with creating your payment gateway.

Ready to accept payments online? We certainly hope so! These are the best online payment options for businesses, large and small.

Consumers made more online payments in 2020 than ever before, and mobile payments in particular are on the rise. According to PWC, the number of consumers making mobile purchases more than doubled from 2010 to 2017, rising from 7% of consumers to 17%. In 2020, as many as 45% of consumers used their smartphone for mobile shopping.

When it comes to accepting payments online, it’s important to offer customers a variety of payment options. According to the 2016 Annual Billing Household Survey, customers use an average of 3.6 different payment methods each month for their bills. Today, consumers have even more payment options available with the advancements in digital wallets and mobile payment applications.

Offering multiple billing and online payment options increases satisfaction by improving customer experience. In addition to creating convenient ways to accept payments, having more options can reduce the time it takes your business to get paid. Many merchants find they save time when accepting payments securely over their phone, website, mobile app, or through a recurring payment schedule that directly debits their customer’s bank account or charges their card on file.

In order to sell products or services in the online marketplace, you need three important components:

Online shopping cart – This is your web-based storefront, or the online version of a brick-and-mortar store. This is where shoppers come to purchase your inventory. You can choose from several eCommerce platforms, such as WooCommerce, Magento, and Volusion. With these platforms, you can easily set up an online store and maximize your eCommerce experience.

Merchant account – For any type of business, payment processing begins with a merchant account. A merchant account is a type of bank account that allows businesses to accept credit card, debit card, and ACH payments. If you plan on accepting payments, you’ll need to get a merchant account.

Payment gateway – In addition to a merchant account, you’ll also need a payment gateway. A payment gateway is a software that lets you securely process credit card payments online. It’s like a POS terminal that operates exclusively online.

Instead of having to find an online shopping cart, merchant account, and payment gateway separately, consider integrating your payments with an all-in-one payment processor. A payment integration gives your business more ways to enhance the customer experience and ensure that payments are processed quickly and securely.

Some payment processors offer both merchant accounts and payment gateways—if possible, apply with these processors so that you have a single point of contact when you encounter problems with your eCommerce credit card processing.

With a payment integration, you can accept payments directly through your online shopping cart. This makes it easy for your customers to complete their purchase, instead of forcing them to move to a third-party website that accepts payments on your behalf.

Without a payment integration, your customers could lose trust in your business. If they have to navigate to a separate site to pay, they may question the security of the payment experience or they may get frustrated and leave your site altogether.

When you accept payments through your online shopping cart, customers provide you with sensitive credit card information, and they expect you to keep that information safe.

However, payment fraud is common, and it could potentially ruin your business.

According to the Association of Certified Fraud Examiners, nearly 50% of small businesses must deal with fraud at some point in their business lifespan. Resolving fraud costs an average of $114,000 each time.

Fortunately, there are steps to help minimize your risk and protect yourself from payment fraud.

Use credit card tokenization on all transactions. Tokenization is an advanced data security method that protects sensitive credit card data at each stage of the transaction process. Tokenization replaces credit card information with an indecipherable code that keeps data safe from fraud.

Make sure to use a payment gateway that stores sensitive credit card information off-site on PCI-compliant servers. This eliminates security risks and liabilities for your business and ensures that customer information is protected at all times.

Additionally, it’s important to use a payment gateway that submits line-item details to the point of sale when processing credit cards. This extra layer of information helps better confirm a customer’s identity, significantly reducing liability if fraud occurs. An all-in-one payment processor should be able to provide this function.

If you want to process credit card payments online, there’s an unavoidable set of fees and charges you must face. When getting your eCommerce store started, make sure you understand what you’re signing up for.

Many eCommerce payment processors will attach a mass of additional fees to your credit card processing services. If you’re not careful, these can quickly add up and create a debt of unnecessary charges, including application fees; long-term contracts; installation, upgrade, and support fees; monthly minimums; and many others.

An online payment processing solution should be transparent with nothing to hide. Some important features to look for include $0 setup fees, $0 upgrade fees, $0 maintenance fees, free in-house customer support, and an experienced chargeback management team.

Look for a flat-rate pricing option. Flat rate pricing guarantees the same low monthly rate for any type of credit card and makes it easy to see exactly how much you’ll pay in eCommerce processing fees each month.

Even the best online payment process can come with a few bumps in the road. The ability to quickly get assistance can help you reduce potential lost sales. Make sure to find an all-in-one payment processor that offers in-house, 24/7 support.

If an issue comes up with your eCommerce credit card processing, you’ll be able to speak to a live representative who can process your inquiries and resolve any issues as soon as possible.

To best serve your needs, your payment processor should have extensive experience working and integrating with online shopping carts. You should also know your relationship manager and be able to contact them directly with any questions regarding your eCommerce account.

There’s a lot to consider when accepting payments online, and many businesses unknowingly complicate the process by skipping several crucial steps. If you prioritize these five aspects of eCommerce payment processing, you’ll be on the right path to getting paid faster and providing the best online payment services for your customers.

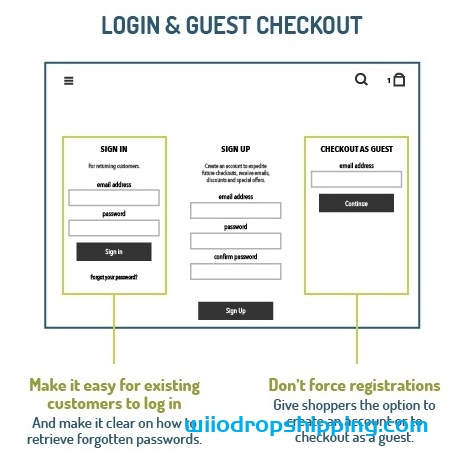

While it’s more convenient for your marketing to require shoppers to create an account before placing an order, it doesn’t always benefit your customers. You might lose people along the way if you don’t give them the option to check out as a guest. Remember: You can always ask them to create an account once they’ve bought from you and feel a little closer to your brand.

Image Credit: VWO

You should also think about offering shoppers the option of logging in with one of their social media profiles, like Facebook or Twitter. This can reduce registration friction because it makes the login process a lot faster. Make sure you add that you’ll never post without the customer’s permission, if applicable.

The caveat of allowing a social login? It’s the one connection shoppers will have to log in — and if anything changes about that connection (the terms of service for the social network change or they delete their account on the network), their ability to log into your site will change, too. So if you’re allowing people to authenticate with social logins, figure out other ways ask for more contact information.

Customers who do have an account with you want to know that their information is safe — even if they forget their login information. To give them peace of mind, be sure to require several verification layers before you restore their login information. For example, if a customer forgets her password, your site could require various security questions before sending an email to a pre-determined email address.

The PCI Security Standards Council (PCI SSC) defines a series of specific Data Security Standards (DSS) that are relevant to all merchants, regardless of revenue and credit card transaction volumes.

If you host and manage your own ecommerce platform, it’s your responsibility to ensure PCI compliance at the required compliance level, which is based on credit or debit card transaction volume over a 12-month period. Most SaaS shopping carts will have PCI compliance built in.

While you can get away with payment processors like PayPal, Stripe, Google Pay, and Amazon Pay if you have a very small website and a low number of transactions, it’s much better to integrate a payment process directly into your website.

With some processors, online shoppers get redirected off your website to a pay site that doesn’t look like yours — which disrupts their experience, visually disconnects them from your brand, and can be confusing or nerve-racking and prompt them to abandon their cart.

An integrated payment solution that processes your customers’ information on your own server allows for more flexibility and customization. Plus, it’s a much smoother experience for your customers.

An integrated payment page will require an SSL certificate to ensure a secure connection. Which brings me to my next point…

Every ecommerce website needs an SSL certificate to protect customers’ personal and credit card information. SSL is the standard security technology that makes sure all data passed between a web server and a browser remain private.

Without it, hackers can steal your customers’ information — and online shoppers won’t feel safe submitting their information on your website. Online shoppers will be able to tell your website’s secure when they see an “https://” at the beginning of your URL, as opposed to just “http://”.

Read our article to learn how to get an SSL certificate on your website.

Speaking of keeping online shoppers at ease, you might want to add credit card logos and security seals to your website to reassure shoppers that your site is a secure, trusted place to do business. Make them visible at least in the shopping cart and checkout phases of your site, or even try integrating them into the footer of your website.

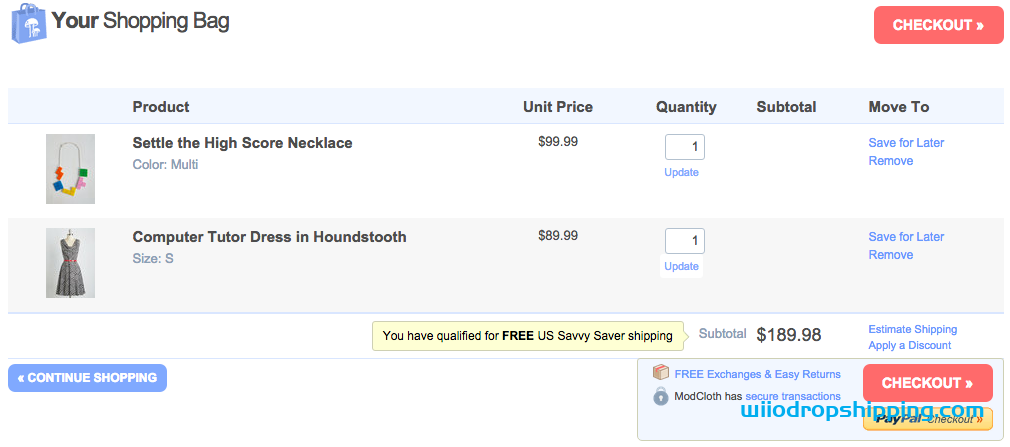

The less time customers have to spend looking for an option to check out, the sooner they’ll take action and buy. We recommend putting checkout calls-to-action — in a color that really stands out — at the top and bottom of your web pages.

Check out this checkout button example from ModCloth (no pun intended):

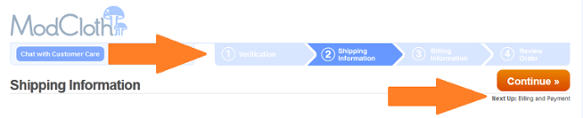

If you need to spread the checkout process across multiple pages, give shoppers a visual indicator of how far they’ve progressed and how long they have left to go. Again, ModCloth does this particularly well:

Shoppers don’t get to physically look at or feel a product before they purchase it online, which can make some people nervous and disincentivize them to buy. To help mitigate this, make your return and refund policy readily available. Consider making it part of the checkout process and even putting it in the footer of your website.

Be sure your policy is succinct, informative, engaging, and easy to understand. Say whether the customer will get a refund or an in-store credit, stipulate a timeframe for returns, define the condition you expect the product to be in, and disclose any fees up-front — like who will cover the cost of shipping.

Online shoppers want to know they can easily reach your company for support — especially if they’re first-time customers. If you don’t give them a clear path to your contact information, they may either hesitate to buy from you, or they may not get the support they need to complete a transaction.

Include contact information like a phone number (with availability hours), email address, street address, and social media accounts. Preferably, list this information as text (not as an image) so it’ll get picked up by search engines in local searches. Some retailers also like to offer live chat options — just be sure that you’ve integrated it with your customer records so you can build smarter marketing campaigns in the future.

Before allowing online shoppers to check out, you’ll want to take them to a detailed confirmation page before finishing the transaction. This page should let them review their cart, give them the option to change the quantity or remove items, include a final price (including tax and shipping), and indicate when the items will be shipped.

The best checkout pages are functional, secure, attractive, and easy to use and navigate. The last thing you need is someone with purchasing intent getting cold feet at the last moment simply because they can’t use your system or don’t have faith in it.

Buyers don’t just buy on desktop. They also buy on mobile, so your payment gateway must be responsible and easy to navigate for mobile users too. If your have a mobile app, you may also need additional functionality to process payments on iOS and Android.

Finally, you’ll want to create a confirmation email that includes the order number, the product, payment, and shipping information, and your return and refund policy — just in case. If possible, use a real “from” email address (instead of [email protected]) that can be answered by a member of your customer support staff. You’ll also want to make the order confirmation page easy to print. This is the time when you can offer guest customers the option to sign up for an account, too.

Setting up your ecommerce business is exciting, even if all the details can be a little overwhelming. With a little bit of planning, you’ll be well on your way to processing ecommerce transactions left and right.